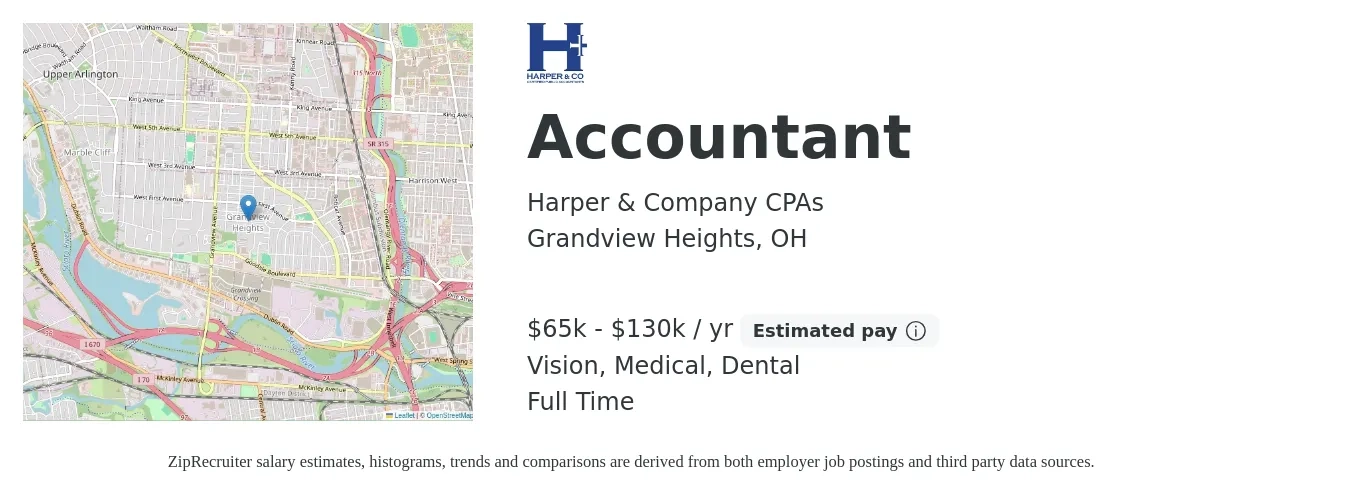

Accountant

- $65,000 to $130,000 Yearly

- Vision , Medical , Dental , Paid Time Off , Life Insurance , Retirement

- Full-Time

Harper & Company CPAs Plus is not your typical CPA firm. We are passionate about helping entrepreneurs enjoy the journey they are on, and we work closely with them throughout the year to guide them strategically towards their goals.

We’ve all worked for firms with a grueling pace driven from the top down, clients that don’t get it, a monotonous office environment, and leaders who manage vs. lead.

Not here — we’ve broken the mold. Every person in our firm plays a very important role in our bigger vision. We pride ourselves in developing our people and doing meaningful work for great clients. We work hard, but we play hard, have balanced lives, and give

back to our community. We leverage technology, ingenuity, and innovative ideas from everyone on our team to create an exceptional Harper & Co. experience for each of our team members and clients.

We are seeking a highly organized, detail-oriented accountant who takes pride in a high quality of work. The ideal candidate possesses a strong understanding of accounting and business fundamentals and is committed to proactively helping assigned clients achieve their business and financial goals. You will collaborate with our team to ensure process efficiency and continue sharing of new tax and business and knowledge.

Responsibilities:

Partner with assigned business clients to help them build the lifestyle and business of their dreams. You will have a group of assigned clients for which you will manage everything from compliance to accounting and advisory work. They rely on a proactive relationship to ensure they are strategically aligned to optimize their tax situation and their financial goals. Ultimately, we are their ‘go to’ advisor for clients for compliance, accounting, payroll, proactive advisory, and business strategy. However, the depth of our relationships with our clients also leads to connecting them with other strategic resources such as financial advisors and insurance agents. Our partnership

with each business client touches almost every financial decision they make.

More Specific Accountabilities:

- Proactively engage clients [in advisory and/or maintenance agreements] in conversation throughout the year in order to assess changes to business and/or personal situations in order to provide the optimal ongoing tax and financial strategy in alignment with their goals

- Review, prepare, reconcile, and analyze accounting records and financial reports.

- Prepare federal, state, or local tax returns for individuals, business establishments, or other organizations. Review prepared returns in accordance with the Harper & Company review guidelines in order to provide a high quality work product for final review.

- Monitor, review, and verify accounting records and transactions for accuracy, timeliness, and adequacy of supporting documentation.

- Ensure compliance with internal policies, agency rules and regulations, and generally accepted accounting principles.

- Review and analyze reports for accuracy prior to distribution.

- Clarify or research issues as necessary.

- Provide input for developing accounting applications, reports, forms, records, and document procedures.

- Assist in the development of financial projections and forecasts.

- Examine accounts, records and compute taxes owed according to prescribed rates, laws, and regulations.

- Advise management regarding effects of business activities on taxes, and on strategies for minimizing tax liability.

- Ensure that the organization complies with taxing authority requirements.

- Represent organization before taxing associations.

- Organize and maintain tax records and conduct tax studies and special projects.

Qualifications Required:

- Education: Bachelor’s degree in accounting, business, or a related field

- Minimum of 5+ years of relevant experience

- Exceptional attention to detail and commitment to error-free work.

- Proficient in QuickBooks or other accounting software.

- Excellent verbal and written communication

- Critical thinking

- Sound judgment and decision making

- Strong time management skills

Compensation and Benefits

- Competitive salary commensurate with experience

- Comprehensive benefits package including health insurance, 401K, profit sharing, paid time off, training for personal development, and flex scheduling

We are proud to be an equal opportunity employer.

We offer Profit Sharing, 401k match plan, and other great benefits!

Address

Harper & Company CPAs

1396 King Avenue Columbus

Grandview Heights, OHIndustry

Finance and Insurance

Posted date

How can the hiring manager reach you?

You Already Have an Account

We're sending an email you can use to verify and access your account.

If you know your password, you can go to the sign in page.